×

About & Data Sources

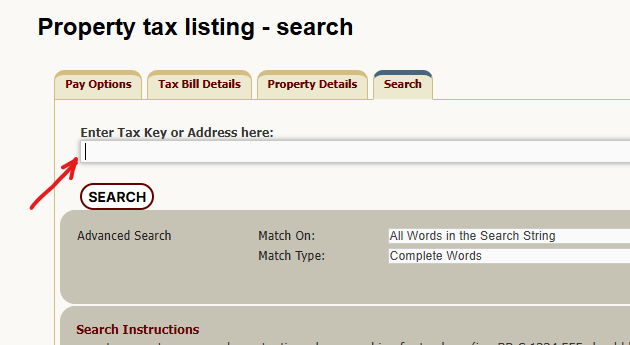

This tool provides instant access to property tax and assessment information for Pewaukee properties using official public data.

Official Data Sources

What You'll See

- Net Property Tax: Annual property tax amount

- Assessed Value: Official property valuation

- Estimated Market Value: Fair market value estimate

- Land & Improvement Values: Breakdown of property value

- Lot Size: Property acreage

- Property Class: Residential, commercial, etc.

- Tax Key: Unique parcel identifier

How It Works

When you enter an address, we:

- Geocode your address to get coordinates

- Query Waukesha County's parcel database

- Return property tax, assessment, and parcel details

- Display the parcel boundary on an interactive map

Privacy

All property data is public record. Your searches are not stored. Queries use official county GIS services.

Questions?

For official tax bills or assessment appeals, contact:

- Waukesha County Treasurer: (262) 548-7029

- Waukesha County Assessor: (262) 548-7900